America's Fiscal Collapse

by Michel Chossudovsky

"We will rebuild, we will recover, and the United States of America will emerge stronger” — President Barack Obama, State of the Union Address 24 Feb 2009

“Those of us who manage the public’s dollars will be held to account—to spend wisely, reform bad habits, and do our business in the light of day—because only then can we restore the vital trust between a people and their government.” — President Barack Obama, A New Era of Responsibility, the 2010 Budget)

“Strong economic medicine” with a “human face”

“Promise amid peril.” The stated priorities of the Obama economic package are health, education, renewable energy, investment in infrastructure and transportation. “Quality education” is at the forefront. Obama has also promised to “make health care more affordable and accessible”, for every American.

At first sight, the budget proposal has all the appearances of an expansionary program, a demand oriented “Second New Deal” geared towards creating employment, rebuilding shattered social programs and reviving the real economy.

Obama’s promise is based on a mammoth austerity program. The entire fiscal structure is shattered, turned upside down.

To reach these stated objectives, a significant hike in public spending on social programs (health, education, housing, social security) would be required as well as the implementation of a large scale public investment program. Major shifts in the composition of public expenditure would also be required: i.e. a move out of a war economy, requiring a movement out of military related spending in favour of civilian programs.

In actuality, what we are dealing with is the most drastic curtailment in public spending in American history, leading to social havoc and the potential impoverishment of millions of people.

The Obama promise largely serves the interests of Wall Street, the defence contractors and the oil conglomerates. In turn, the Bush-Obama bank “bailouts” are leading America into a spiralling public debt crisis. The economic and social dislocations are potentially devastating.

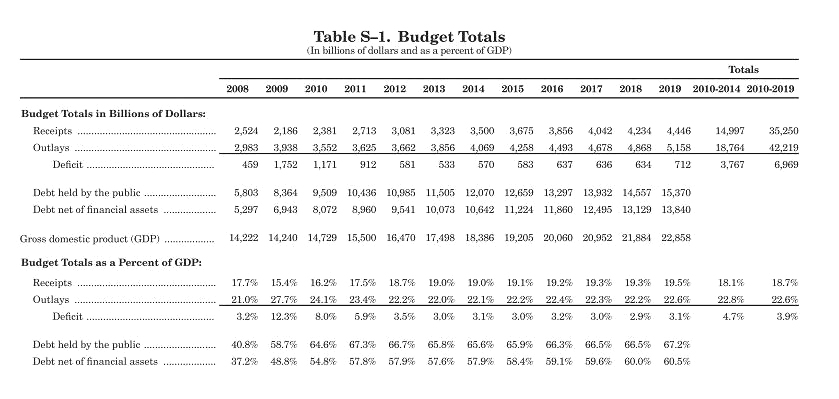

Obama’s budget submitted to Congress on February 26, 2009 envisages outlays for the 2010 fiscal year (commencing October 1st 2009) of $3.94 trillion, an increase of 32 percent. Total government revenues for the 2010 fiscal year, according to preliminary estimates by the Bureau of Budget, are of the order of $2.381 trillion.

The predicted budget deficit (according to the president’s speech) is of the order of $1.75 trillion, almost 12 percent of the U.S. Gross Domestic Product.

War and Wall Street

The budget diverts tax revenues into financing the war. It legitimizes the fraudulent transfers of tax dollars to the financial elites under the “bank bailouts”.

The pattern of deficit spending is not expansionary. We are not dealing with a Keynesian style deficit, which stimulates investment and consumer demand, leading to an expansion of production and employment.

The “bank bailouts” (involving several initiatives financed by tax dollars) constitute a component of government expenditure. Both the Bush and Obama bank bailouts are hand outs to major financial institutions. They do not not constitute a positive spending injection into the real economy. Quite the opposite. The bailouts contribute to financing the restructuring of the banking system leading to a massive concentration of wealth and centralization of banking power.

A large part of the bailout money granted by the Us government will be transferred electronically to various affiliated accounts including the hedge funds. The largest banks in the US will also use this windfall cash to buy out their weaker competitors, thereby consolidating their position. The tendency, therefore, is towards a new wave of corporate buyouts, mergers and acquisitions in the financial services industry.

In turn, the financial elites will use these large amounts of liquid assets (paper wealth), together with the hundreds of billions acquired through speculative trade, will be used to buy out real economy corporations (airlines, the automobile industry, Telecoms, media, etc ), whose quoted value on the stock markets has tumbled.

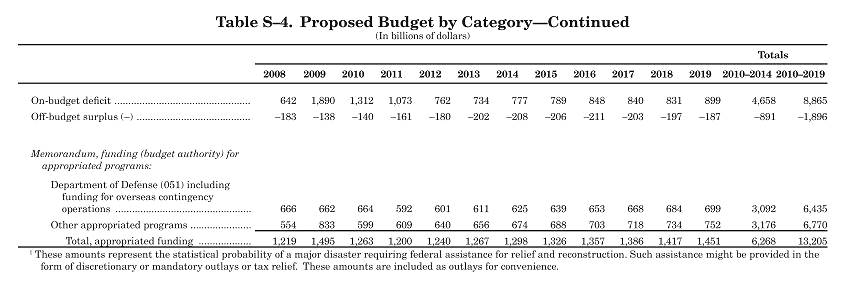

In essence, a budget deficit ( combined with massive cuts in social programs) is required to fund the handouts to the banks as well as finance defence spending and the military surge in the Middle East war. Obama’s budget envisages:

1. defense spending of $534 billion for 2010, a supplemental 130 billion dollar appropriation for fiscal 2010 for the wars in Afghanistan and Iraq, and a supplemental $75.5 billion emergency war funding for the rest of the 2009 fiscal year. Defence spending and the Middle East war, with various supplemental budgets, is (officially) of the order of 739.5 billion. Some estimates place aggregate defence and military related spending at $ 1 trillion+.

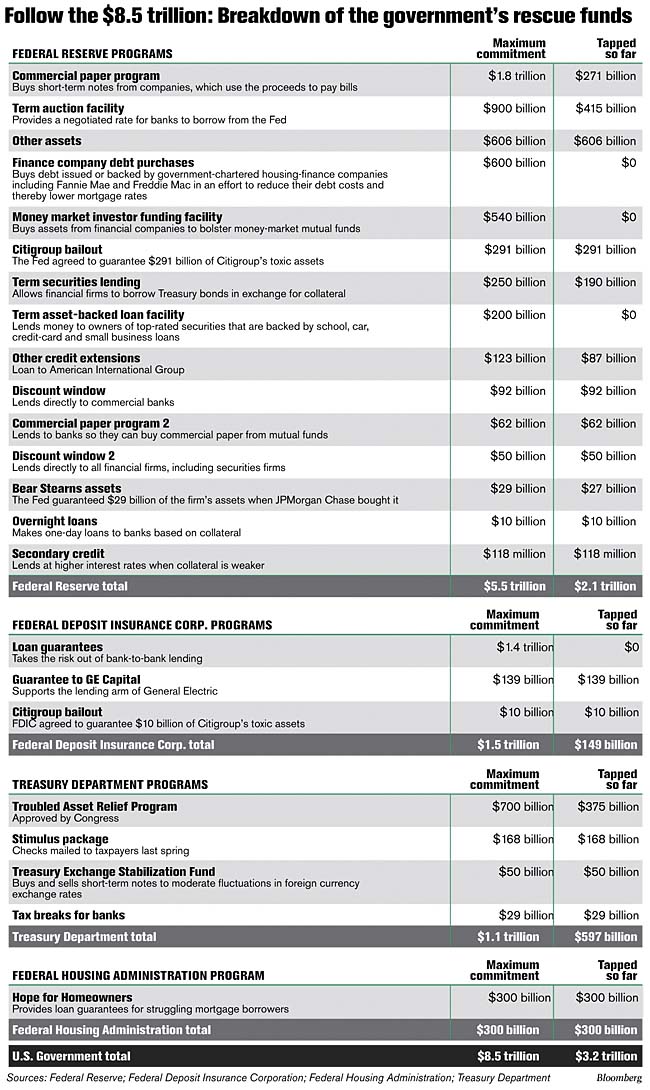

2. A bank bailout of the order of $750 billion announced by Obama, which is added on to the 700 billion dollar bailout money already allocated by the outgoing Bush administration under the Troubled Assets Relief Program (TARP). The total of both programs is a staggering 1.45 trillion dollars to be financed by the Treasury. It should be understood that the actual amount of cash financial “aid” to the banks is significantly larger than $1.45 trillion. (See Table 2 below).

3. Net Interest on the outstanding public debt is estimated by the Bureau of the Budget) at $164 billion in 2010.

The order of magnitude of these allocations is staggering. Under a “balanced budget” criterion –which has been a priority of government economic policy since the Reagan era–, almost all the revenues of the federal government amounting to $2.381 trillion would be used to finance the bank bailout (1.45 trillion), the war ($739 billion) and interest payments on the public debt ($164 billion). In other words, no money would be left over for other categories of public expenditure.

TABLE 1 Budgetary allocations to Defence (FY 2009 and 2010), the Bank Bailout and Net Interests on the Public Debt (FY 2010) $

Defence including Supplementary allocations; $534 billion (FY 2010), $130 billion supplemental (FY 2010), $75.5 billion emergency funding (FY2009) | 739.5 |

|---|---|

*Bank bailout (TARP plus Obama) | 1450.0 |

Net Interest | 164.0 |

TOTAL | 2353.5 |

Total Individual (Federal) Income Tax Revenues (FY 2010) | 1061.0 |

Total Federal Government Revenue (FY 2010) | 2381.0 |

See also Office of Management and Budget

* The officially announced bank bailouts to be financed from Treasury Funds. The timing of disbursements could take place over more than one fiscal years fiscal years. The actual value of bank bailout cash injections is substantially higher.

The Budget Deficit

Moreover, as a basis of comparison, all the revenue accruing from individual federal income taxes ($1.061 trillion), (FY 2010) namely all the money households across America pay in the form of federal taxes, will not suffice to finance the handouts to the banks, which officially are of the order of 1.45 trillion. This amount includes the $ 700 billion (granted during FY 2009) under the TARP program plus the proposed $ 750 billion granted by the Obama administration.

While TARP and Obama’s proposed bailout are to be disbursed over Fy 2009 and 2010, they nonetheless represent almost half of total government expenditure ( half of Obama’s $3.94 trillion budget for fiscal 2010), which is financed by regular sources of revenue ($2381 billion) plus a staggering $1.75 trillion budget deficit, which ultimately requires the issuing of Treasury Bills and government bonds.

The feasibility of a large short-term expansion of the public debt at a time of crisis is yet another matter, particularly with interest rates at abysmally low levels.

The budget deficit is of the order of 1.75 trillion. Obama acknowledges a 1.3 trillion-dollar budget deficit, inherited from the Bush administration. In actuality, the budget deficit is much larger .

The official figures tend to underestimate the seriousness of the budgetary predicament. The $1.75 trillion dollar budget deficit figure is questionable because the various amounts disbursed under TARP and other related bank bailouts including Obama’s announced $750 billion aid program to financial institutions are not acknowledged in the government’s expenditure accounts.

“The aid hasn’t been requested formally, but appears in a line item “for potential additional financial stabilization efforts,” according to the budget overview. The budget office calculated a $250 billion net cost to taxpayers this year, because it anticipates it would eventually recoup some, though not all, of the money expended to help financial companies.

The funds would come on top of the $700 billion rescue package approved last October by Congress. The White House budgets no money for fiscal 2010 and beyond for such aid.” (Bloomberg, February 27, 2010)

| |||||||||||||||||||||||||||||||||||||||||||

| Subscribe to the Global Research E-Newsletter | |||||||||||||||||||||||||||||||||||||||||||

Spread the word! Forward to a friend! | |||||||||||||||||||||||||||||||||||||||||||

For further enlightening info enter a word or phrase into the search box @ New Illuminati:

@ http://nexusilluminati.blogspot.com (or click on any tag at the bottom of the page for direct references)

And see

The Her(m)etic Hermit - http://hermetic.blog.com

New Illuminati – http://nexusilluminati.blogspot.com

New Illuminati on Facebook - http://www.facebook.com/pages/New-Illuminati/320674219559

This material is published under Creative Commons Copyright (unless an individual item is declared otherwise by copyright holder) – reproduction for non-profit use is permitted & encouraged, if you give attribution to the work & author - and please include a (preferably active) link to the original along with this notice. Feel free to make non-commercial hard (printed) or software copies or mirror sites - you never know how long something will stay glued to the web – but remember attribution! If you like what you see, please send a tiny donation or leave a comment – and thanks for reading this far…

From the New Illuminati – http://nexusilluminati.blogspot.com

Promo Terbesar via Agen QQ Kyu-Kyu Elista Region Capital Situs www.pokerusia.top Melalui BPD Sumsel Babel Syariah Kode Bank 121.

ReplyDeleteWelcome to brotherhood Illuminati where you can become

ReplyDeleterich famous and popular and your life story we be change totally my name is Dan Jerry I am here to share my testimony on how I join the great brotherhood Illuminati and my life story was change immediately . I was very poor no job and I has no money to even feed and take care of my family I was confuse in life I don’t know what to do I try all my possible best to get money but no one work out for me each day I share tears, I was just looking out my family no money to take care of them until one day I decided to join the great Illuminati , I come across them in the internet I never believe I said let me try I email them.all what they said we happen in my life just started it was like a dream to me they really change my story totally . They give me the sum of $1,200,000 and many thing. through the Illuminati I was able to become rich, and have many industry on my own and become famous and popular in my country , today me and my family is living happily and I am the most happiest man here is the opportunity for you to join the Illuminati and become rich and famous in life and be like other people and you life we be change totally.If you are interested in joining the great brotherhood Illuminati.then contact him whatsspa +2347051758952 or you need my assistance morganiilluminatirich@gmail.com