Economists Are Full of Bullshit

Don’t let the Nobel Prize fool

you. Economics is not a science

‘A Nobel prize in

economics implies that the human world operates much like the physical world.’

Photograph: Jasper Rietman

The

award glorifies economists as tellers of timeless truths, fostering hubris and

leading to disaster

A Nobel prize in economics implies that the human world operates much like the physical world: that it can be described and understood in neutral terms, and that it lends itself to modelling, like chemical reactions or the movement of the stars. It creates the impression that economists are not in the business of constructing inherently imperfect theories, but of discovering timeless truths.

To illustrate just how dangerous that kind of belief can be, one only need to consider the fate of Long-Term Capital Management, a hedge fund set up by, among others, the economists Myron Scholes and Robert Merton in 1994. With their work on derivatives, Scholes and Merton seemed to have hit on a formula that yielded a safe but lucrative trading strategy. In 1997 they were awarded the Nobel prize. A year later, Long-Term Capital Management lost $4.6bn (£3bn)in less than four months; a bailout was required to avert the threat to the global financial system. Markets, it seemed, didn’t always behave like scientific models.

In the decade that followed, the same over-confidence in the power and wisdom of financial models bred a disastrous culture of complacency, ending in the 2008 crash. Why should bankers ask themselves if a lucrative new complex financial product is safe when the models tell them it is? Why give regulators real power when models can do their work for them?

Many economists seem to have come to think of their field in scientific terms: a body of incrementally growing objective knowledge. Over the past decades mainstream economics in universities has become increasingly mathematical, focusing on complex statistical analyses and modelling to the detriment of the observation of reality.

Consider this throwaway line from the former top regulator and London School of Economics director Howard Davies in his 2010 book The Financial Crisis: Who Is to Blame?: “There is a lack of real-life research on trading floors themselves.” To which one might say: well, yes, so how about doing something about that? After all, Davies was at the time heading what is probably the most prestigious institution for economics research in Europe, located a stone’s throw away from the banks that blew up.

Howard Davies, pictured

in 2006. Photograph: Eamonn McCabe for the Guardian

Compare that humility to that of former central banker Alan Greenspan, one of the architects of the deregulation of finance, and a great believer in models. After the crash hit, Greenspan appeared before a congressional committee in the US to explain himself. “I made a mistake in presuming that the self-interests of organisations, specifically banks and others, were such that they were best capable of protecting their own shareholders and their equity in the firms,” said the man whom fellow economists used to celebrate as “the maestro”.

While this was apparently new to Greenspan it was not to anthropologist Karen Ho, who did years of fieldwork at a Wall Street bank. Her book Liquidated emphasises the pivotal role of zero job security at Wall Street (the same system governs the City of London). The financial sociologist Vincent Lépinay’s Codes of Finance, a book about the division in a French bank for complex financial products, describes in convincing detail how institutional memory suffers when people switch jobs frequently and at short notice.

Perhaps the most pernicious effect of the status of economics in public life has been the hegemony of technocratic thinking. Political questions about how to run society have come to be framed as technical issues, fatally diminishing politics as the arena where society debates means and ends. Take a crucial concept such as gross domestic product. As Ha-Joon Chang makes clear in 23 Things They Don’t Tell You About Capitalism, the choices about what not to include in GDP (household work, to name one) are highly ideological. The same applies to inflation, since there is nothing neutral about the decision not to give greater weight to the explosion in housing and stock market prices when calculating inflation.

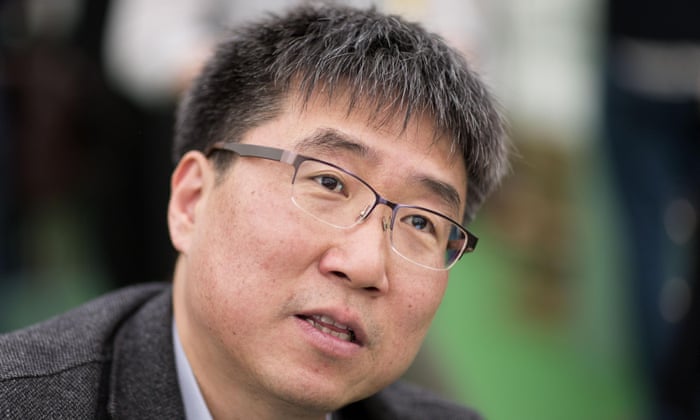

Ha-Joon Chang, pictured

at the Hay-on-Wye festival, Wales. Photograph: David Levenson/Getty Images

Would it not be extremely useful to take economics down one peg by overhauling the prize to include all social sciences? The Nobel prize for economics is not even a “real” Nobel prize anyway, having only been set up by the Swedish central bank in 1969. In recent years, it may have been awarded to more non-conventional practitioners such as the psychologist Daniel Kahneman. However, Kahneman was still rewarded for his contribution to the science of economics, still putting that field centre stage.

Think of how frequently the Nobel prize for literature elevates little-known writers or poets to the global stage, or how the peace prize stirs up a vital global conversation: Naguib Mahfouz’s Nobel introduced Arab literature to a mass audience, while last year’s prize for Kailash Satyarthi and Malala Yousafzai put the right of all children to an education on the agenda. Nobel prizes in economics, meanwhile, go to “contributions to methods of analysing economic time series with time-varying volatility” (2003) or the “analysis of trade patterns and location of economic activity” (2008).

A revamped social science Nobel prize could play a similar role, feeding the global conversation with new discoveries and insights from across the social sciences, while always emphasising the need for humility in treating knowledge by humans about humans. One good candidate would be the sociologist Zygmunt Bauman, whose writing on the “liquid modernity” of post-utopian capitalism deserves the largest audience possible. Richard Sennett and his work on the “corrosion of character” among workers in today’s economies would be another. Will economists volunteer to share their prestigious prize out of their own acccord? Their own mainstream economic assumptions about human selfishness suggest they will not.

- Swimming with Sharks by Joris Luyendijk (Guardian Faber, £12.99). To order a copy for £6.99, go to bookshop.theguardian.com or call 0330 333 6846. Free UK p&p over £10, online orders only. Phone orders min. p&p of £1.99.

From The Guardian

@ http://www.theguardian.com/commentisfree/2015/oct/11/nobel-prize-economics-not-science-hubris-disaster

For information about banking see http://nexusilluminati.blogspot.com/search/label/banksters

- Scroll down

through ‘Older Posts’ at the end of each section

Hope you like this

not for profit site -

It takes hours of work every day by

a genuinely incapacitated invalid to maintain, write, edit, research,

illustrate and publish this website from a tiny cabin in a remote forest

Like what we do? Please give anything

you can -

Contribute any amount and receive at

least one New Illuminati eBook!

(You can use a card

securely if you don’t use Paypal)

Please click below -

Spare Bitcoin

change?

Xtra Images –

Video -

For further enlightening

information enter a word or phrase into the random synchronistic search box @

the top left of http://nexusilluminati.blogspot.com

And see

New Illuminati – http://nexusilluminati.blogspot.com

New Illuminati on Facebook - https://www.facebook.com/the.new.illuminati

New Illuminati Youtube Channel - https://www.youtube.com/user/newilluminati/playlists

New Illuminati’s OWN Youtube Videos

-

New Illuminati on Google+ @ For

New Illuminati posts - https://plus.google.com/u/0/+RamAyana0/posts

New Illuminati on Twitter @ www.twitter.com/new_illuminati

New Illuminations –Art(icles) by

R. Ayana @ http://newilluminations.blogspot.com

The Her(m)etic Hermit - http://hermetic.blog.com

DISGRUNTLED SITE ADMINS PLEASE NOTE –

We provide a live link to your original material on your site (and

links via social networking services) - which raises your ranking on search

engines and helps spread your info further!

This site is published under Creative Commons (Attribution) CopyRIGHT

(unless an individual article or other item is declared otherwise by the copyright

holder). Reproduction for non-profit use is permitted

& encouraged - if you give attribution to the work & author and include

all links in the original (along with this or a similar notice).

Feel free to make non-commercial hard (printed) or software copies or

mirror sites - you never know how long something will stay glued to the web –

but remember attribution!

If you like what you see, please send a donation (no amount is too

small or too large) or leave a comment – and thanks for reading this far…

Live long and prosper! Together we can create the best of all possible

worlds…

From the New Illuminati – http://nexusilluminati.blogspot.com

Perhaps we need a clear definition of what the real economy is. The real economy is simply the science of production, distribution, and consumption of the entire human population. And yes, any political and or financial interference getting in the way of the science related to the real economy renders it to the realm of fictional economy from which Oscar awards should be presented to the greatest bs artists.

ReplyDeleteAnd reality based technocrats concern themselves with the reality based economy. The science of production, distribution, and consumption of all goods and services. Phony technocrats live in the Alice's Wonderland economy where Nobel Prizes are granted to all those who keep the bs going and growing.

ReplyDeleteJust prior to the long predicted GFC, 40% of the 'world economy' was comprised of 'finance' - a HUGE utterly nonproductive parasite that was rapidly devouring its host. Now it's returned like a recurrent tumour - the 'finance industry' is nothing but a parasitic drain on the real wealth and resources of the planet. It's surprising so few can see it for what it is; a scam, a ripoff, totally imaginary bullshot that's literally costing us all the Earth - but then again, most people seem to imagine they're profiting from it by being in 'debt' to it!

Delete" Economics, this seems to say, is not a social science but an exact one, like physics or chemistry"

ReplyDeleteSaying that a Nobel Prize elevates something to the realm of a scientific discipline seems like a non-sequitur. There's a Nobel for Peace and also one for Literature but no one claims that those are scientific disciplines.